Communications

I build high-impact communications platforms for rapidly growing small organizations and publicly traded companies - engaging and informing diverse audiences including executives, investors, technical experts, media, clients, and employees.

My Edge

I excel in both high-level strategy and hands-on implementation – with expertise in planning, storytelling, and people management, as well as writing company-wide communications, press releases, newsletters, and social media posts. I’m fully immersed in the latest tech stack, working hands-on with a range of tools for email, mobile, social media, website building, analytics, intranet, and CMS.

⇓

Challenge

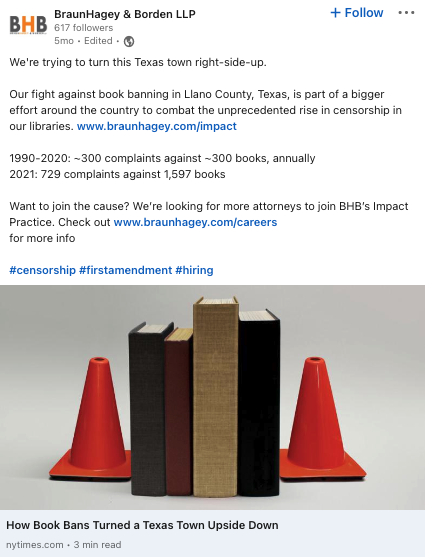

For years a professional services firm had a weak presence on LinkedIn - sporadic posting, few followers, and low post engagement.

Solution

Increased company page post cadence and improved post quality (visual and copy)

Increased interaction with other posts

Implemented employee social media advocacy tool

Results

80% internal adoption rate of new tool

20% increase in new followers on LinkedIn

300% increase in engagement with company’s posts

Social Media

Case Study | Organic LinkedIn Growth

Sample Work | Social Media Posts

Social media strategy & content planning

HootSuite scheduling and tracking

Employee advocacy tools

Copy & Canva graphic design

Press

Media relations & press handling

Talking points

Journalist networking and relationship building

Press releases

Sample Work | Articles & Media Appearances

I’ve led internal communications strategy and content creation for rapidly growing companies and publicly traded companies. I approach all internal communications with empathy, tailoring my messaging for each unique audience to translate, educate, and illuminate. I craft communications that drive change management, employee engagement, and stakeholder buy-in. Sample work available upon request.

Internal Communications

Employee All Hands

Investor & Shareholder Calls

Earnings Calls

Townhall Meetings

Change Management

Service Trainings

Talking Points

Scripts

Intranet & Wikis

Employee All Hands Investor & Shareholder Calls Earnings Calls Townhall Meetings Change Management Service Trainings Talking Points Scripts Intranet & Wikis

I’ve led corporate communications strategy and content creation for fast-growing, global firms and publicly traded corporations - including client and investor communications, employer brand communications, earnings calls, keynote presentations, thought leadership, customer service communications, crisis communications, and newsletters.

Corporate Communications

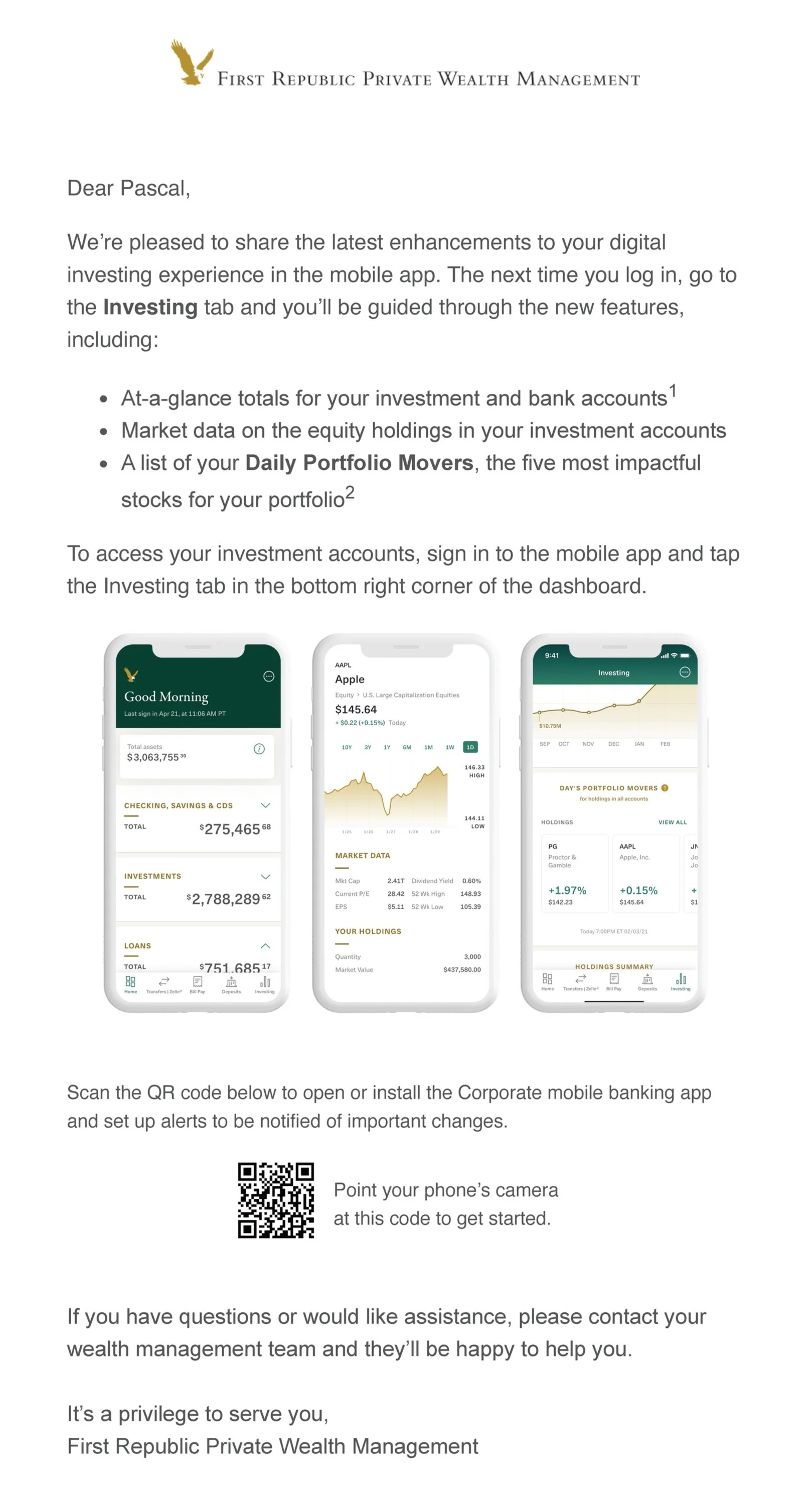

As part of the launch of a new mobile experience, we created in-app banners and sent clients email announcements.

GTM Strategy

Email copy and design

Airship content and design

Internal comms strategy & execution

Execution in Marketo

Sample Work | Client Communications

We sent an email to investors to address recent regulatory announcements and a market downturn. We published a revised version of the text in our November 2018 newsletter, which goes out to 30,000 people internationally including investors, prospective investors, portfolio companies, and members of the press. Below is the publicly published text.

Comms strategy and planning

Copy

Execution in HubSpot and publication on Medium

Sample Work | Investor Communications

Many of you are wondering what to make of the recent volatility in the crypto markets and the industry-related stories making headlines. We’d like to share our insights on the recent developments, how they may (or may not) relate to Pantera’s investments, as well as our perspectives on investing in this space in the current climate and in the future.

SEC ANNOUNCEMENT

As you may know, the SEC issued a press release on November 16, announcing settled charges against two non-compliant ICOs. In sum, tokens that are deemed securities that did sales to U.S. non-accredited investors after the 2017 DAO Report was released without relying upon an exemption, are considered non-compliant. Non-compliant projects will likely end up having to offer to buy back the token at the sale price from investors and will have to register as securities. The analysis of whether a given token is a security will depend on facts and circumstances, including the degree to which the project is live and functional and the way it is marketed.

Could this impact projects in Pantera’s ICO Fund?

While we believe the vast majority of the projects in our portfolio should not be affected, approximately 25% of our fund’s capital is invested in projects with liquid tokens that sold to U.S. investors without using Regulation D or Regulation S. If any of these projects are deemed to be securities, the SEC’s position could adversely affect them. Of these projects, about a third (approximately 10% of the portfolio) are live and functional and, while they could technically continue without further development, ending development would hinder their progress. It is worth noting that the same applies to Ethereum, and SEC officials have suggested that Ethereum is sufficiently decentralized to not be viewed as a security. Additionally, some of the projects in our portfolio were done before the 2017 DAO Report. We will monitor our positions for further relevant developments.

Fortunately, approximately 75% of the fund was invested in with what we believe to be compliant exempt offerings, using exemptions like Regulation D or Regulation S, and with at least one year lockups so as to not violate securities law issues.

BITCOIN CASH HARD FORK

On November 15th, Bitcoin Cash (BCH) forked as a result of an ongoing debate over the future roadmap of the protocol. The two main factions are those in support of Bitcoin Cash Adjustable Blocksize Cap (ABC) vs those in support of Satoshi’s Vision (SV). Simply put, ABC is seeking to optimize the Bitcoin Cash protocol with the introduction of new features. SV will restore many of Bitcoin’s original opcodes and scripts with the most significant change being an increase in the block size to 128 megabytes. Roger Ver, CEO of Bitcoin.com, and Jihan Wu of Bitmain, are prominent figures in support of ABC. Craig Wright, the self-proclaimed Bitcoin founder and Chief Scientist of nChain, is a vocal proponent of SV. At the time of writing this, many exchanges have returned the BCH ticker to the ABC fork. The SV chain is likely to trade as BSV and is currently valued at around 90% of the price of BCH. Since BCH is a top five cryptocurrency by market cap, it’s possible some of the volatility we are seeing is a result of this fork.

WHAT’S NEXT

After such a prolonged drawdown in the market, it’s important to reflect and reevaluate the thesis behind utility tokens, whether we’ll ever bridge the gap from speculation to actual usage, valuations, and the market overall.

We firmly believe that tokens will achieve real world usage. In fact, it’s already starting to happen in the depths of this bear market. Over 1% of all ETH is locked up in MakerDAO (a collateralized stable coin project on Ethereum). 0x and Augur are starting to see very modest usage numbers, and many more projects will go live over the course of the next year. That said, we don’t expect to see a significant increase in adoption until we have cheaper and easier fiat on-ramps and much more scalable underlying blockchains. As long as ETH only does 10 TPS (Transactions per Second), few financial dapps will really takeoff. This will be a 2–3 year process for these networks to scale.

As we’ve said previously, eventually the market will become less correlated, but we don’t think it will happen soon. At some point assets will trade solely on their own merits. If there are ten assets in the space with real cash flows, and a thousand without — those with cash flows will be valued according to their actual yields. Those assets are starting to appear, and we’re buying them, but they’ll have to grow enough for the yield to start to become significant before the market starts pricing them fully.

Ultimately, we believe solutions like Bakkt, ErisX, and Fidelity’s blockchain suite will enable institutional investors to enter the space.